Selling land involves navigating a legal and regulatory landscape that can be complex and, at times, overwhelming. Besides understanding the intricacies of zoning laws and taxes, sellers must also manage paperwork, title searches, and other legal requirements to ensure a smooth and successful transaction. In this comprehensive guide provided by 7Land Corp, we’ll delve into the most important legal and regulatory aspects of land sales to help you confidently steer through each stage of the selling process.

Equip yourself with the knowledge needed to understand and manage the legal and regulatory landscape of land sales by diving into this informative guide. With a strong foundation in these aspects, you can ensure a seamless transaction, minimize potential issues, and maximize the return on your investment.

1. Zoning Laws and Land Use Regulations

One of the primary challenges that land sellers face is understanding and adhering to zoning laws and land use regulations. These laws determine how a specific piece of land can be utilized—whether for agriculture, residential, commercial, or industrial purposes. It’s essential to understand and disclose the zoning restrictions applicable to your property from the onset, as it can significantly impact a prospective buyer’s interest. Some crucial zoning considerations include the following:

- Local Zoning Laws: Research and familiarize yourself with the zoning classification of your land, study local zoning ordinances, and understand any potential restrictions or allowances.

- Rezoning: If your land’s current zoning classification limits its potential, investigate whether a rezoning request may be considered. Keep in mind that rezoning can be a lengthy and costly process with no guarantee of success.

- Land Use Regulations: Depending on your property’s location, additional land use regulations may apply, such as floodplain restrictions, environmental guidelines, or building codes. Thoroughly research and disclose all relevant regulations to ensure transparency and avoid potential legal disputes.

2. Title Searches and Property Boundaries

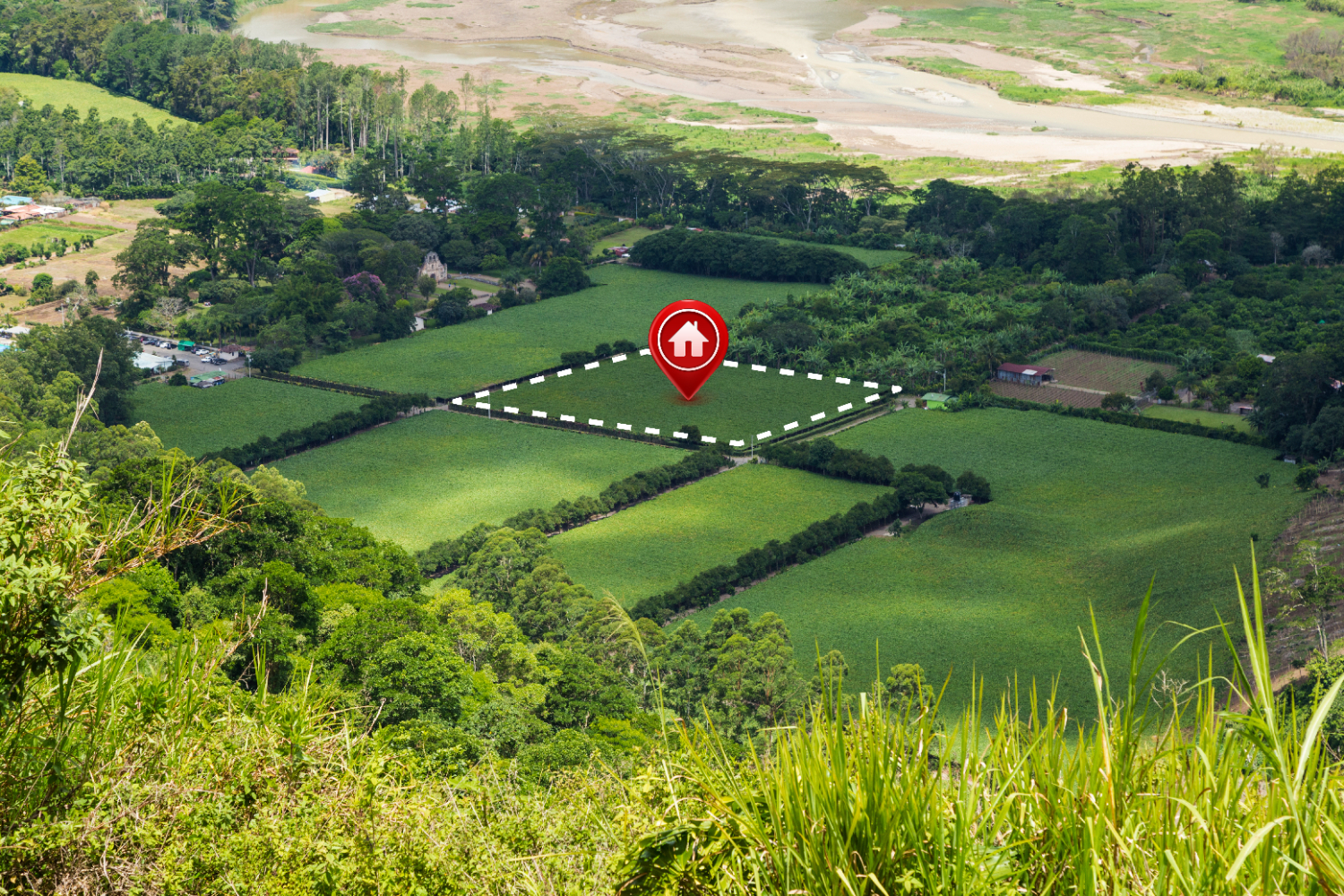

Conducting a thorough title search and verifying property boundaries is essential to avoid potential issues during the selling process. These steps can usefully inform potential buyers about the property’s ownership history, outstanding liens, and accurate boundary lines. Some key considerations include the following:

- Title Searches: A title search involves reviewing public records to confirm the land’s legal owner and identify any outstanding claims, liens, or encumbrances. Gaining this clarity can help prevent complications during the transaction.

- Property Surveys: Commission a professional surveyor to conduct a property survey and create or update your land’s legal description. This survey will verify property boundaries, rights-of-way, and easements, which can influence a buyer’s decision and minimize the chances of disputes after the sale.

3. Disclosure Requirements and Legal Paperwork

Legally, land sellers are required to provide specific disclosures to potential buyers, informing them of any known material facts or issues that could affect the property’s value or desirability. Ensuring transparency and clarity in legal documentation can help to build trust, streamline the transaction, and protect you from potential liabilities. Essential steps to consider include the following:

- Seller Disclosure Statement: In many states, sellers must complete a seller disclosure statement, providing information about known defects, soil conditions, easements, and other relevant property details.

- Environmental Disclosures: Some states require additional disclosure forms, such as providing details about hazardous materials, wetlands, or contamination risks on the property.

- Preparing Legal Documentation: Several legal documents must be prepared during the land sale process. These may include the purchase agreement, deed, and disclosure forms. Consult with a real estate attorney or enlist the services of a qualified land agent to ensure accuracy and compliance.

4. Working with a Professional Land Agent

Navigating the legal and regulatory landscape of land sales can be a daunting task for sellers. Partnering with a professional land agent, like the experts at 7Land Corp, can significantly increase the efficiency, security, and success of the process. Some key advantages of working with a land agent include the following:

- Expert Guidance: Professional land agents possess extensive knowledge of legal and regulatory requirements and can offer valuable guidance on managing challenges and adhering to best practices.

- Effective Marketing Strategy: Land agents are skilled in crafting and implementing targeted marketing strategies to find the ideal buyer for your land.

- Negotiation Support: Having a seasoned land agent manage negotiations and facilitate communication between parties can lead to more favorable terms, better protection of your interests, and a smoother sales experience.

5. Tax Implications and Financial Considerations

In addition to navigating the legal and regulatory aspects, sellers must also consider the tax implications and financial factors associated with selling land. Understanding these aspects can help sellers make informed decisions and maximize their financial returns from the transaction. Here are some key points to consider:

- Capital Gains Tax: Selling land may trigger capital gains tax, which is calculated based on the difference between the sale price and the property’s adjusted basis. Sellers should be aware of the applicable tax rates and any exemptions or deductions they may qualify for.

- 1031 Exchange: Sellers looking to defer capital gains tax can explore the option of a 1031 exchange, which allows them to reinvest the proceeds from the sale into a like-kind property. However, strict guidelines and timelines must be followed to qualify for this tax-deferred exchange.

- Cost Basis: Understanding the property’s cost basis, which includes the original purchase price plus any capital improvements, can help sellers accurately calculate their capital gains and potential tax liability.

- Financial Planning: Sellers should consider consulting with a financial advisor to develop a comprehensive financial plan that takes into account the proceeds from the land sale, tax obligations, and long-term financial goals.

- By carefully considering the tax implications and financial considerations associated with selling land, sellers can make strategic decisions to optimize their financial outcomes and achieve their objectives.

Successfully Navigating Legal and Regulatory Challenges

By understanding and addressing the legal and regulatory aspects of land sales, you can maximize the success and smoothness of your transaction. By disclosing relevant property information, abiding by zoning laws, conducting thorough title searches, and enlisting the support of a professional land agent, you can guarantee a more transparent and seamless experience for both parties.

Sell land with confidence by reaching out to the experienced professionals at 7Land Corp. Our team is here to assist with your land sale, ensuring a truly rewarding and hassle-free experience from start to finish.